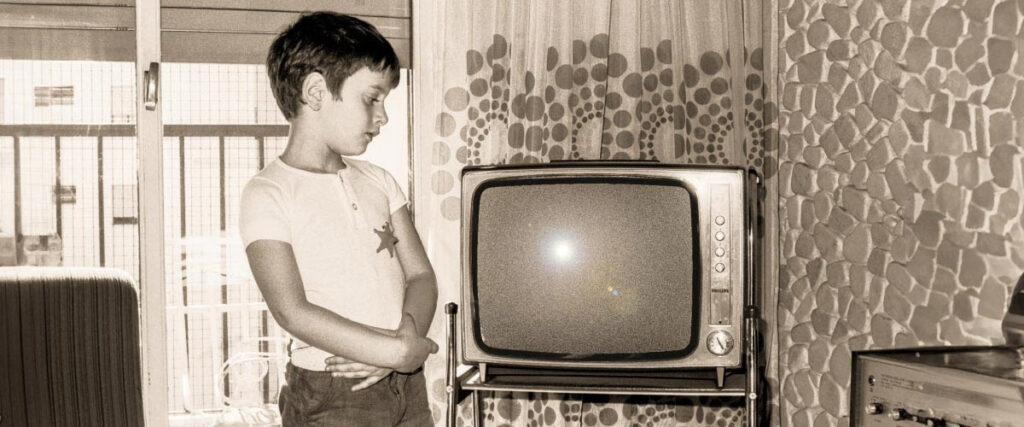

Picture this:

You’re 120 years old.

You’ve been retired for…not 20, not 30, but 60 years.

You’ve had a lot of time, but now––not a lot of money.

This may sound like the setup for an unfortunate sci-fi movie, but these days, longevity is an extremely important issue when planning for retirement.

Life expectancies keep rising with advancements in modern medicine, which could potentially give you multiple decades of post-work life.

To enjoy those years to the fullest, it’s time to start thinking about longevity in retirement now.

That’s the focus of this month’s Visual Insights Newsletter.

More time in retirement isn’t always about more opportunities, it may also invite new complexities and risks.

Addressing those now can help you experience a potentially long and deeply fulfilling retirement.

Discover what it takes to plan for longevity in retirement.

Talk soon,

Art

Arthur Creel, Investment Advisor

P.S. What’s the first (or next) big thing you’re going to do as a retiree? Why? Hit “Reply” and share your plans. I’d love to read what you’re looking forward to in post-work life.

Risk Disclosure: Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance does not guarantee future results.

This material is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. The content is developed from sources believed to be providing accurate information; no warranty, expressed or implied, is made regarding accuracy, adequacy, completeness, legality, reliability, or usefulness of any information. Consult your financial professional before making any investment decision. For illustrative use only.

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific situation with a qualified tax professional.

Carmichael Creel Investments only transacts business in states where it is properly registered or excluded or exempt from registration requirements. For additional information regarding our services, or to receive a hard copy of our firm’s disclosure documents (Form ADV Part 2A and Form ADV Part 2B), please call us at 615-595-5825 or visit our website at carmichaelcreel.com. No client or prospective client should assume any information presented or made available on this communication serves as the receipt of, or substitute for, personalized individual advice.

Investing in the markets involves gains and losses and may not be suitable for all investors. The information presented should not be considered a solicitation to buy or sell any security or to engage in a particular investment or financial planning strategy. Individual client asset allocations and investment strategies differ based on varying degrees of diversification and other factors. Diversification does not guarantee a profit or guarantee against a loss.