As you may have noticed, the S&P 500 broke the 5,000 level recently for the first time in history as investors embraced euphoria.1

And then tumbled as investors got jittery.2 Then yo-yo’d a bit more. These types of abrupt moves can make owning stocks feel like a roller coaster ride!

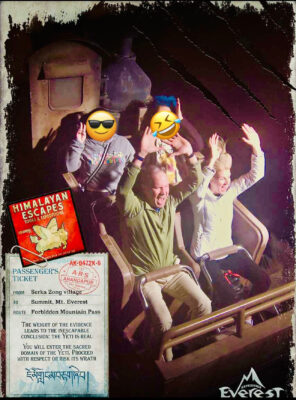

Speaking of rollercoasters…, I’ve attached a picture of Heather and me riding Expedition Everest at Disney’s Animal Kingdom a few weeks ago. By the look on our faces you probably can’t tell we really loved the ride!

So What’s going on with the stock market?

Let’s talk about investor psychology.

Fear and greed are the two halves of the investor psychology coin.

When investors are feeling greedy and exuberant, they buy in the hopes of making a big profit, driving markets up.

When sentiment turns, and they start feeling fearful, they sell in the hopes of avoiding losses, driving markets down.

The rollercoaster of investor psychology can take over and push markets in directions that don’t always jibe with the underlying financial and economic fundamentals.

We’re seeing that push-pull in action right now as investors weigh the likelihood of future interest rate cuts and price out different scenarios.

What positive factors support the rally?

1. Employment is strong, and the most recent report stunned economists with over 350,000 jobs added in January. Though some of the surprise increase can be attributed to seasonal effects, the overall trend is encouraging.3

2. The U.S. economy may be re-accelerating. The running “unofficial” forecasts by the Atlanta Fed show Q1 economic growth coming in above 3%, trending higher than earlier estimates.4

3. The Fed has forecasted multiple rate cuts in 2024, which would make credit cheaper to access and support business growth.5

What negative factors could trigger a pullback?

1. Pullbacks are normal and expected after markets experience a sustained rally.

2. Inflation is generally trending lower, but the latest data shows prices rose more than expected in January.6 If inflation remains stubborn, it could raise the specter of a “hard landing” recession and spook markets.

3. Investors are counting on interest rates coming down soon. If the Fed indicates it will delay cuts, investors could rethink their optimism.

Bottom line: Volatility is high, and we’ll likely see markets continue to rally and retreat as investors consider their next moves and price in new data.

It is very hard, if not impossible, to predict which scenario will play out in the future but we continue to watch closely and for potential changes in market direction.

In the meantime, do you have any questions? Hit “reply” and let me know.

Now for a closing Dad Joke:

I had a dream last night that I was trapped in a muffler shop.

When I woke up I was exhausted. 😉

Watchfully,

Art

Arthur Creel, Investment Advisor

(CLICK HERE FOR A PDF VERSION OF THIS INFORMATION)

Sources

- https://www.cnbc.com/2024/02/

11/stock-market-today-live- updates.html - https://www.cnbc.com/2024/02/

13/stock-market-today-live- updates.html - https://www.marketwatch.com/

livecoverage/jobs-report-for- january-employment-growth- seen-slowing-in-report-vital- to-fed-outlook/card/jobs- report-shows-353-000-gain-in- hiring-in-january- unemployment-rate-stays-at-3- 7–aYXgACPOLljLMpejC9Bf - https://www.atlantafed.org/-/

media/documents/cqer/ researchcq/gdpnow/ RealGDPTrackingSlides.pdf - https://www.cnbc.com/select/

when-will-interest-rates-drop/ - https://www.cnbc.com/2024/02/

13/cpi-inflation-january-2024- consumer-prices-rose- 0point3percent-in-january- more-than-expected-as-the- annual-rate-moved-to- 3point1percent.html

Risk Disclosure: Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance does not guarantee future results.

This material is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. The content is developed from sources believed to be providing accurate information; no warranty, expressed or implied, is made regarding accuracy, adequacy, completeness, legality, reliability, or usefulness of any information. Consult your financial professional before making any investment decision. For illustrative use only.

Carmichael Creel Investments only transacts business in states where it is properly registered or excluded or exempt from registration requirements. For additional information regarding our services, or to receive a hard copy of our firm’s disclosure documents (Form ADV Part 2A and Form ADV Part 2B), please call us at 615-595-5825 or visit our website at carmichaelcreel.com. No client or prospective client should assume any information presented or made available on this communication serves as the receipt of, or substitute for, personalized individual advice.

Investing in the markets involves gains and losses and may not be suitable for all investors. The information presented should not be considered a solicitation to buy or sell any security or to engage in a particular investment or financial planning strategy. Individual client asset allocations and investment strategies differ based on varying degrees of diversification and other factors. Diversification does not guarantee a profit or guarantee against a loss.