Just a quick note to offer some perspective on the many headlines floating around.

There are plenty of things to be worried about right now, so I’d like to pause for a second to remember the abundance in our lives.

Especially when so many folks are suffering.

When the world stresses me out, I remind myself to be grateful for what I have.

I’m grateful for my family and friends.

I’m grateful for my health.

I’m grateful to have a roof over my head and food on the table.

I’m grateful to have work that gives me purpose.

What are you grateful for right now?

I’ll start…the Creels have a new family member!

Last week our son Nathan married Genevieve! It was a beautiful event in Charleston, South Carolina, surrounded by friends and family who came to celebrate the new Mr. and Mrs. Creel! Here we are at the Rehearsal Dinner.

Now let’s dive into the headlines….

What’s going on with markets right now?

A lot of fear, volatility, and sudden relief, I think.

We just experienced three months of losses while markets were driven by fear.

And then a sudden bounce on jubilation that the Federal Reserve might be done raising rates this year.1

These whips and snaps are not an unusual pattern for markets.

It’s common to see major drops just about every year.

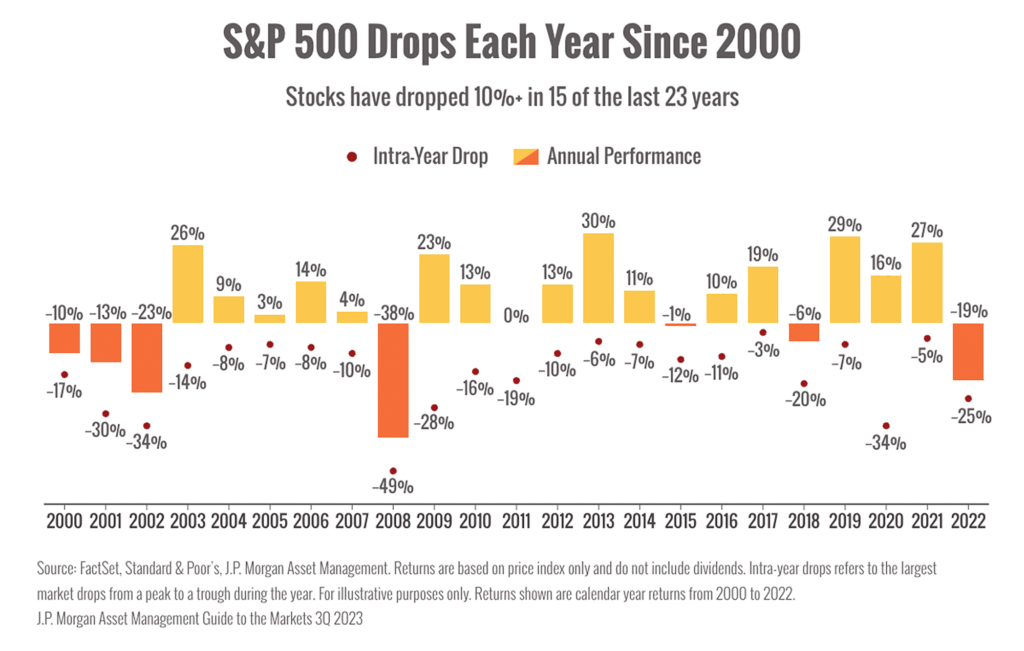

The chart below shows annual market pullbacks since 2000.

We can see that 10%+ corrections have happened in 15 of the last 23 years, even in years where the overall market was positive.2

What will markets do next?

That’s hard to say because we’ve seen “good” news get mixed reviews by traders.

Recent data shows that the economy seems to be doing well.

Consumer confidence remained high in October, showing Americans are feeling pretty upbeat.3

Paychecks rose more than expected in Q3, which is great news for American workers, but suggests inflation remains persistent.

The first estimate of Q3 GDP showed that the economy grew even faster than expected, growing 4.9% at an annualized rate.4

If investors feel optimistic about future business prospects, the rally could continue.

However, they could get fearful again if the Fed signals another hike or recession headlines return.

Bottom line, while the economy is still strong, investors are feeling jittery.

It’s hard to know which way markets will turn next and we’re expecting more volatility ahead.

We’re watching and analyzing and will be in touch with more updates as needed.

As always, if you have questions or concerns, please reach out.

We are living in challenging and uncertain times, but there is always time for a Dad joke:

I had a dream last night that I was trapped in a muffler shop…and when I woke up…I was exhausted! 😉

With Gratitude,

Art

Investment Advisor

(CLICK HERE FOR A PDF VERSION OF THIS INFORMATION)

P.S. Do you ever feel guilty for relaxing or seeking out fun when you know others are suffering?

That’s not a bad thing, necessarily. Here’s an interesting article that shows why it’s not selfish to want to enjoy life, even when others are struggling.

Sources

1. https://www.cnbc.com/2023/11/

3. https://www.cnbc.com/2023/10/

Risk Disclosure: Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance does not guarantee future results.

This material is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. The content is developed from sources believed to be providing accurate information; no warranty, expressed or implied, is made regarding accuracy, adequacy, completeness, legality, reliability, or usefulness of any information. Consult your financial professional before making any investment decision. For illustrative use only.

Carmichael Creel Investments only transacts business in states where it is properly registered or excluded or exempt from registration requirements. For additional information regarding our services, or to receive a hard copy of our firm’s disclosure documents (Form ADV Part 2A and Form ADV Part 2B), please call us at 615-595-5825 or visit our website at carmichaelcreel.com. No client or prospective client should assume any information presented or made available on this communication serves as the receipt of, or substitute for, personalized individual advice.

Investing in the markets involves gains and losses and may not be suitable for all investors. The information presented should not be considered a solicitation to buy or sell any security or to engage in a particular investment or financial planning strategy. Individual client asset allocations and investment strategies differ based on varying degrees of diversification and other factors. Diversification does not guarantee a profit or guarantee against a loss.