A new deal finally put the debt ceiling issue to rest (for now, anyway), and stocks are rallying.

Are we on the brink of a new bull market?

Before we attempt to answer this question let’s pause for announcements.

If you are looking for a sign:

In other headlines…..Carmichael Creel Investments (originally Carmichael Capital, Inc.) is celebrating our 30th business anniversary! Click the link HERE to read an article (with great photos of young Art and Claude!) written by the Downtown Franklin Association.

Now back to the original question:

Are we on the brink of a new bull market?

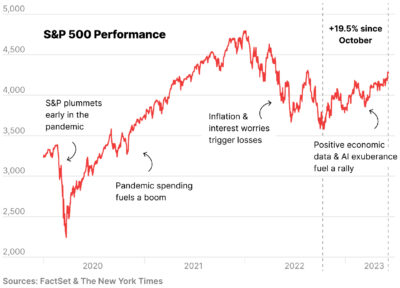

We might be. The S&P 500 has soared in 2023 and is up nearly 20% from its October 2022 low.1

That’s pretty surprising given the concerns about interest rates, recessions, banks, and a war in Europe, so some analysts are wary.

How do we know when we’re in a bull market?

First, let’s acknowledge that the terms “bull” and “bear” are just shorthand for general market trends and don’t necessarily mean anything scientific.

Generally, a 20% decline from a market high defines a bear market.

(You might remember all the headlines from 2022 when the current one started.)

However, bull markets are a little harder to call.

A 20% increase from a bear market low doesn’t necessarily kick off a bull market.2

Since a 20% increase still leaves you shy of your original market high, many analysts don’t consider it a proper bull market yet.

They want to see stocks achieve a new historic high before officially calling an end to the bear market.3

We’re not there yet.

But, it’s probably fair to say that we’re flirting with a bull market.

What’s driving the recent rally?

Here’s where analysts have some concerns.

The recent rally centers around a few big tech stocks and seems to be energized by enthusiasm for artificial intelligence.

That means the rally lacks breadth. Your average S&P 500 company has only seen gains of less than 3% this year.3

The fact that the rally relies on the performance of a few high-flying stocks could spell volatility ahead.

What should I expect in the weeks ahead?

Hard to say. Markets seem to have momentum and we could see the rally continue.

However, recession and interest rate concerns are still bubbling under the surface, so let’s not break out the party favors yet.4

Let’s celebrate just how far we’ve come since the bear market began last year, but stay flexible enough to accept any pullbacks and volatility that might lie ahead.

I can’t let you leave on a serious note, so how about a Dad joke?

I’m writing a book on Reverse Psychology…

Please don’t buy it!

Art

Arthur Creel, Investment Advisor

(CLICK HERE FOR A PDF VERSION OF THIS INFORMATION)

Sources:

- Yahoo Finance. S&P 500 closing price performance between October 12, 2022 and June 5, 2023.

- https://www.axios.com/2023/06/06/us-stock-market-bullish-vs-bearish

- https://www.nytimes.com/2023/06/05/business/stocks-bull-market.html

- https://finance.yahoo.com/news/recession-talk-rages-on-despite-robust-jobs-market-191308453.html

Risk Disclosure: Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance does not guarantee future results.

This material is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. The content is developed from sources believed to be providing accurate information; no warranty, expressed or implied, is made regarding accuracy, adequacy, completeness, legality, reliability, or usefulness of any information. Consult your financial professional before making any investment decision. For illustrative use only.

Carmichael Creel Investments only transacts business in states where it is properly registered or excluded or exempt from registration requirements. For additional information regarding our services, or to receive a hard copy of our firm’s disclosure documents (Form ADV Part 2A and Form ADV Part 2B), please call us at 615-595-5825 or visit our website at carmichaelcreel.com. No client or prospective client should assume any information presented or made available on this communication serves as the receipt of, or substitute for, personalized individual advice.

Investing in the markets involves gains and losses and may not be suitable for all investors. The information presented should not be considered a solicitation to buy or sell any security or to engage in a particular investment or financial planning strategy. Individual client asset allocations and investment strategies differ based on varying degrees of diversification and other factors. Diversification does not guarantee a profit or guarantee against a loss.