Have you noticed Mom or Dad showing signs of decline?

Are you worried about your elderly uncle (or other relative or friend) living at home by himself?

You’re not alone.

Many of us will find ourselves making care decisions for our parents or other beloved elders.

It’s not an easy place to be because it’s hard to see them struggle to live independently.

While I can’t make the process any easier for you, I hope I can offer some guidance on your journey.

Like many of you, Heather and I are working members of the “sandwich generation.” This group consists of people usually in their 50’s-60’s who are helping care for their own children as well as aging parents.

Our experiences range from moving a mother from her home of 30+ years to a new place close to us, to being a part of the last few years of our Dads’ lives. Here is a picture of Barney McKee and Art Creel, Sr.

Our fathers died within one day of each other in 2018. Both were “bigger than life” characters and notorious joke tellers. Looking back on the last few years for Art Sr. and Barney, I have many good memories but also some regrets for things I could have done better.

To make the process a little easier for you, here are 6 tips for making your loved ones’ golden years go more smoothly.

Tip #1: Start talking about care plans as early as possible

Many elders shy away from conversations about their future care needs.

However, gently bringing attention to the topic from a place of love and support long before urgent needs arise can help the whole family get on board with a plan.

With many desirable communities experiencing high demand, finding a placement may take longer than expected, so planning ahead helps.

Tip #2: Identify any current needs

If you already know that your parent or elder needs help, it’s useful to identify which “activities of daily living” they may no longer be able to manage.

Knowing this will help you gauge what kind of assistance they need.

An elder with physical issues may struggle with bathing or dressing but still be able to handle their finances.

An elder experiencing cognitive decline may be able to handle their personal care but need help with transportation, money management, and housekeeping.

Finding the right level of care for their needs can help them remain independent as long as possible and keep costs in check.

Tip #3: Identify their financial resources

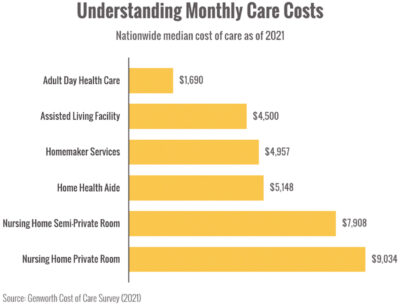

Care can cost quite a bit, so knowing what assets they have—income, investments, long-term care policies, insurance, benefits, etc.—can help determine what they can afford.

The chart below shows some nationwide care statistics, but the actual cost of a placement will be influenced by location, level of care, type of facility, pricing structures, and more.1

Tip #4: Be clear about your own resources and expectations

Many, many factors influence care expectations within families.

Being clear with your family about what you can and cannot contribute in terms of time, money, and caregiving is critical.

It may be a difficult conversation, especially if your family’s expectations of you are outside what you can provide.

However, setting boundaries and accountability creates clarity about needed services and care.

Tip #5: Research their options

There are a lot of ways to help your loved ones age gracefully. Learning about which services and facilities are available and within their resources can empower you to help them make good decisions.

Sometimes, home renovations and local support can be enough to support aging-in-place.

In other cases, moving to a care community can offer elders the support they need to thrive.

Tip #6: Understand the steps involved in getting into a community

Many facilities operate with a waitlist so it may be challenging to quickly find a placement when the time comes to move.

Starting early helps. Asking for referrals, taking tours of facilities together (if they’re willing), and becoming informed about how each community works can help you all understand the process.

When you’ve identified a place you may be able to place a deposit to get on the waitlist, giving them the option to accept a spot when it opens.

You’re not alone in this journey.

I’m here for support as you help your loved ones navigate the care process.

If you ever have questions or need advice, please reach out.

Now in honor of Barney and Art Sr., here is a Dad joke before we go:

Heather told me to put Ketchup on the grocery list.

Now I can’t read anything. 😉

Warmly,

Arthur Creel, Investment Advisor

P.S. Helping your parents navigate care decisions can bring up a lot of thoughts about our own aging. If you’d like to discuss your own financial and logistical preparations, please let me know.

(CLICK HERE FOR A PDF VERSION OF THIS INFORMATION)

Sources:

Risk Disclosure: Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance does not guarantee future results.

This material is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. The content is developed from sources believed to be providing accurate information; no warranty, expressed or implied, is made regarding accuracy, adequacy, completeness, legality, reliability, or usefulness of any information. Consult your financial professional before making any investment decision. For illustrative use only.

Carmichael Creel Investments only transacts business in states where it is properly registered or excluded or exempt from registration requirements. For additional information regarding our services, or to receive a hard copy of our firm’s disclosure documents (Form ADV Part 2A and Form ADV Part 2B), please call us at 615-595-5825 or visit our website at carmichaelcreel.com. No client or prospective client should assume any information presented or made available on this communication serves as the receipt of, or substitute for, personalized individual advice.

Investing in the markets involves gains and losses and may not be suitable for all investors. The information presented should not be considered a solicitation to buy or sell any security or to engage in a particular investment or financial planning strategy. Individual client asset allocations and investment strategies differ based on varying degrees of diversification and other factors. Diversification does not guarantee a profit or guarantee against a loss.