New research has found a new “magic” retirement savings number.

(I explain how inflation factors in below)

I say “magic” because if you put 10 people in a room, you’ll get 10 different opinions about how much you should save for retirement.

And this estimate is no different.

More on retirement later. For now I want to be a proud Dad and brag a little…

Here is a picture of the family celebrating Eva’s recent graduation from the University of Georgia. She graduated Magna Cum Laude with a degree in Psychology! And best of all, she has a teaching job starting in the fall in New York City. Go Eva!!

Now back to the topic of retirement planning.

Northwestern Mutual surveyed 4,588 adults and found:

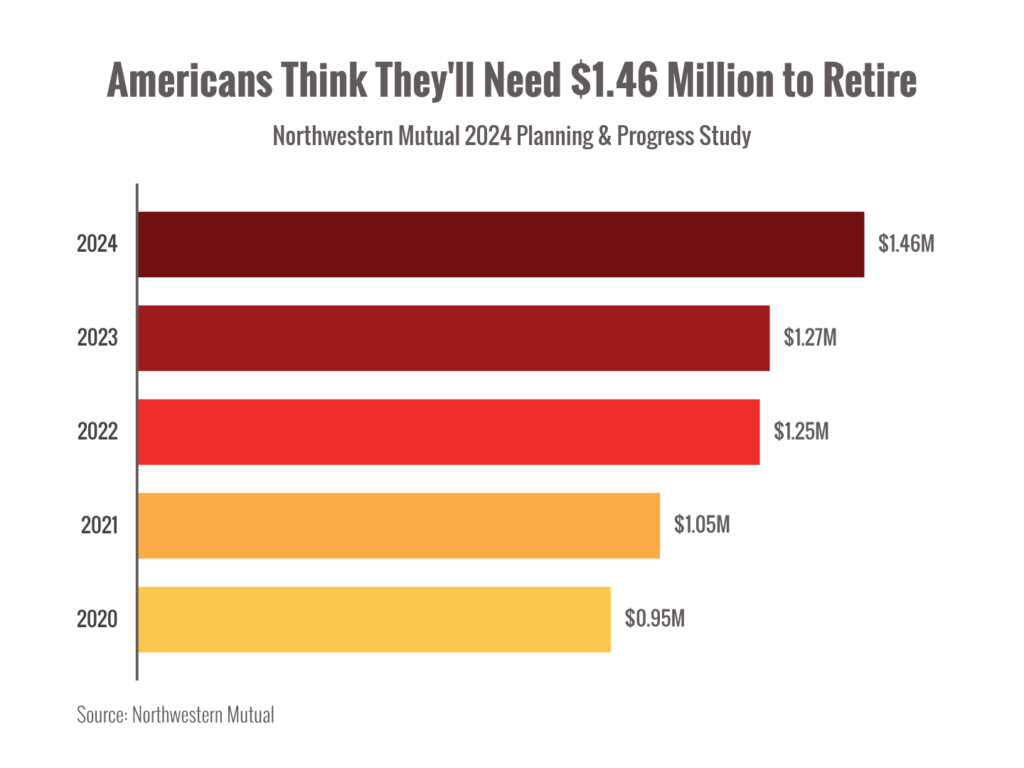

The new “magic” number for a comfortable retirement is $1.46 million.1

It’s up 15% from last year’s $1.27 million number and is also an eye-popping 53% higher than the 2020 estimate.2

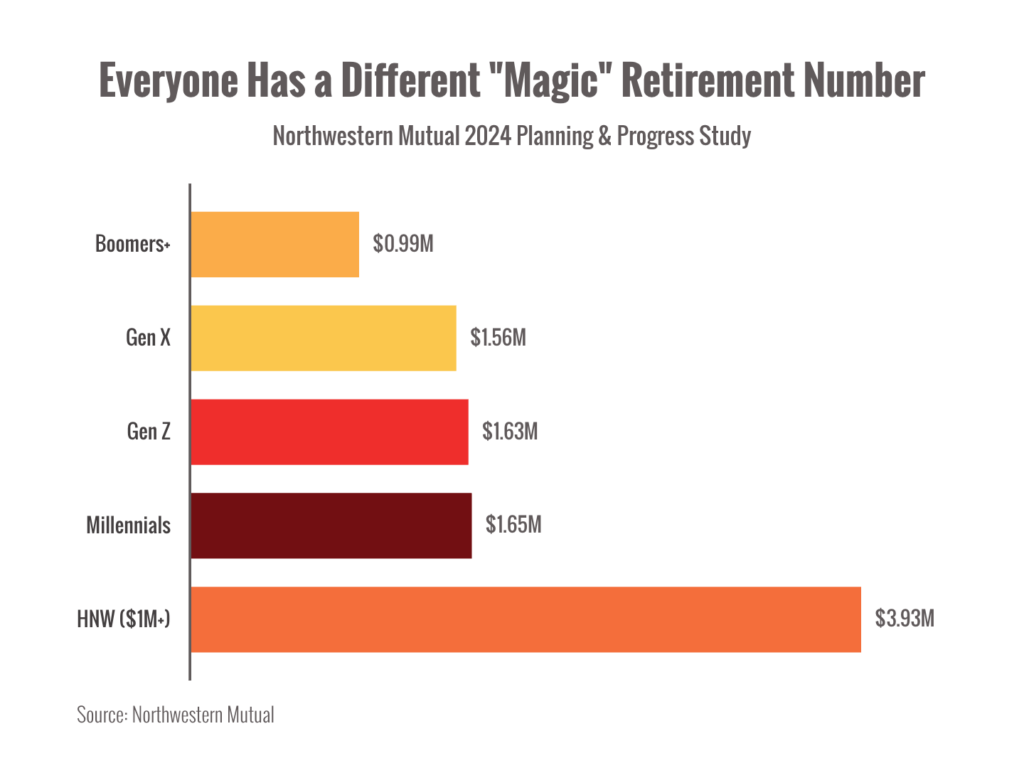

Broken down by generation, the numbers get even bigger.

Gen Z and Millennials expect to need around $1.6 million to comfortably retire.1

And folks with over $1 million saved believe they’ll need nearly $4 million to be comfortable.2

Does the average American actually need $1.46 million to retire comfortably?

Maybe not.

Another “magic” number from Fidelity suggests Americans should have 10x their income saved by age 67.3

If we 10x the median household income of $74,580, we get $745,800.4

That’s about half of the first “magic” number.

For some Americans, $750k will be enough to retire on.

For others, it won’t be nearly enough to support the lifestyle they want.

Planning for retirement isn’t about “magic” numbers.

When we consider that the average retirement savings hovers around $88,000, the gap between desire and reality has never been greater.1

Most people don’t really know how much money they will need in retirement, and can wildly overestimate it.

As much as humans like to look for simple answers and rules to follow, turning a portfolio into retirement income is complex.

I wish I could give each person in that survey an advisor to help them calculate their own retirement target instead of guessing.

Inflation is weighing heavily on our fears for the future.

Inflation has been very high for the last few years, and (in my opinion) the survey reflects the worry many feel about how much prices are rising.

And how long high inflation will linger.

The latest March report shows that prices rose 3.5% over the last 12 months.5

That’s stronger than analysts had expected, and increases concerns that inflation isn’t actually tamed yet.

This negative surprise is likely to push back a Fed interest rate cut and stoke market volatility.

We’re keeping an eye on the situation and will be in touch with updates as needed.

And of course, if you have questions, just reply to this message.

Now for a closing Dad joke:

“I hired a handy man and gave him a to-do list.

When I got home, only items 1, 3, and 5 were done.

Turns out, he only does odd jobs.” #

Be well,

Art

Arthur Creel, Investment Advisor

(CLICK HERE FOR A PDF VERSION OF THIS INFORMATION)

Sources

- https://news.northwesternmutual.com/2024-04-02-Americans-Believe-They-Will-Need-1-46-Million-to-Retire-Comfortably-According-to-Northwestern-Mutual-2024-Planning-Progress-Study

- https://news.northwesternmutual.com/2023-06-22-Americans-Believe-They-Will-Need-1-27-Million-to-Retire-Comfortably,-According-to-Northwestern-Mutual-Planning-Progress-Study

- https://www.fidelity.com/viewpoints/retirement/how-much-do-i-need-to-retire

- https://www.census.gov/library/publications/2023/demo/p60-279.html

- https://www.cnbc.com/2024/04/10/cpi-inflation-march-2024-consumer-prices-rose-3point5percent-from-a-year-ago-in-march.html

# source: Logan Lisle

Risk Disclosure: Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance does not guarantee future results.

This material is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. The content is developed from sources believed to be providing accurate information; no warranty, expressed or implied, is made regarding accuracy, adequacy, completeness, legality, reliability, or usefulness of any information. Consult your financial professional before making any investment decision. For illustrative use only.

Carmichael Creel Investments only transacts business in states where it is properly registered or excluded or exempt from registration requirements. For additional information regarding our services, or to receive a hard copy of our firm’s disclosure documents (Form ADV Part 2A and Form ADV Part 2B), please call us at 615-595-5825 or visit our website at carmichaelcreel.com. No client or prospective client should assume any information presented or made available on this communication serves as the receipt of, or substitute for, personalized individual advice.

Investing in the markets involves gains and losses and may not be suitable for all investors. The information presented should not be considered a solicitation to buy or sell any security or to engage in a particular investment or financial planning strategy. Individual client asset allocations and investment strategies differ based on varying degrees of diversification and other factors. Diversification does not guarantee a profit or guarantee against a loss.